Latest forum news

About PLUS-Forum

The PLUS-Forum “Digital Uzbekistan“ (former "Fintech, Banks and Retail")- is devoted to key issues of interaction between state structures, banking sector and trade retail. Among its strategic objectives is to give an additional impetus to the development of the economy of Uzbekistan, to promote international cooperation in banking and financial technologies, as well as the deployment of new promising projects, including international ones. The Forum will provide similar assistance to the development of online and offline retail, including its effective further transformation.

The Forum speakers are world-class top managers of the industry, businessmen and representatives of the public sector with competencies in various industry areas in the region and experience in implementing international projects.

A unique opportunity to find new customers and demonstrate your company’s latest solutions, services and equipment to a professional audience.

An opportunity to organize meetings with key decision makers: from start-ups to international corporations. Forum participants are industry stakeholders directly responsible for formulating and making decisions.

The optimal and effective event format in our segment is the Forum featuring a conference, exhibition and round tables held on a single site.

We invite companies and organizations interested in the implementation of ongoing initiatives, joint projects and the development of cooperation with partners in Uzbekistan.

PLUS-Forum is supported by:

The Central Bank

of the Republic of Uzbekistan

NATIONAL AGENCY OF PERSPECTIVE PROJECTS

OF THE REPUBLIC OF UZBEKISTAN

COMPETITION PROMOTION AND

CONSUMER PROTECTION COMMITTEE

OF THE REPUBLIC OF UZBEKISTAN

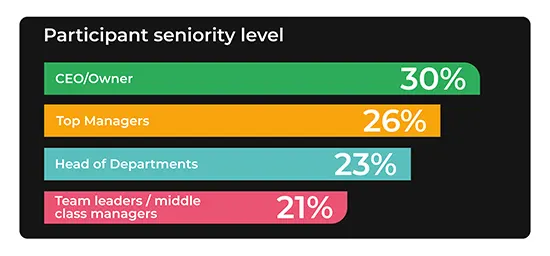

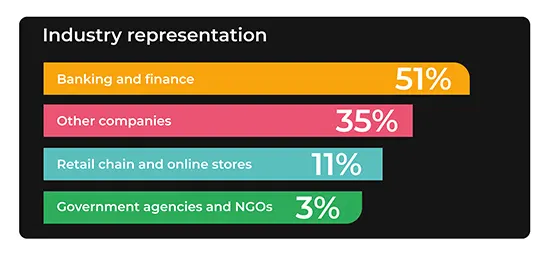

Who are our participants?

- Fintech companies and startups, IT parks, gas pedals

- Business angels, venture capital firms

- IT, telecom, and integrators

- World leading experts of banking and payment industry

- Managers of retail networks, e-commerce, wholesale companies, shopping malls

- Payment systems

- Research agencies and consulting companies

- International banking community, including participants of country markets throughout Central Asia (top management of banks, MFIs, investment funds)

- Insurance companies, management of logistics companies

Reasons for participation

Our advantages

Join us!

Forum Topics

Development of Uzbekistan – head on to a modern digital society

Digital transformation. Digitalization of banking and retail. Digitalization of public services and systems of interaction with citizens

Improving the payment environment. Challenges. Main trends

Fintech as a culture of the banking industry

Issues related to IT technologies and artificial intelligence. Transformation of tasks and solutions required for a digital society. Big Data

Open Banking and Open API. Impact on the traditional banking market

Blockchain and smart contracts. Innovations that become everyday routine

Cryptocurrency industry 2024. Complex trajectory under the influence of various vectors

Digital currencies of central banks. Goals and objectives that will be solved using CBDC

Islamic finance. Analysis of reasons, prospects and effectiveness

Instant (faster) payments systems

The future of neobanks. Modern NeoBANK 4.0 = XaaS (Anything as a Service). Other development scenarios for neobanks

Money transfer systems. Changes amidst the new geopolitical conditions

IT landscape of a retail bank and transformation. A look from the inside. The role of Agile in digitalization

Bank cards. Tokenization and virtualization

Biometrics and identification. Role. Place. Implementation methodology

Main areas of digital facilities and services. Digital mortgage. Digital lending. Development of brokerage services by banks

ATM and POS terminal networks. Cardless service at an ATM. Online fiscalization on POS devices

Financial literacy. Countering social engineering. Creating conditions for effective economic development

Cybersecurity. Cyber threats and information security

Small and medium business. SMB as a catalyst for the development of modern economies

Transformation of the retail sector. Acquiring business strategies. Sustainable market development

E-commerce in Central Asia. The market is taking off. Marketplaces. Capabilities of new business strategies and technologies

BNPL. Successful competitor to consumer lending and credit cards

Online fiscalization – government control of trade and tax collection. Digital transformation in the tax system. Effective interaction with taxpayers

Customer experience in the digital age. Modern customer loyalty. Digital onboarding – clients acquisition and retaining

Speakers of the Forum

Sponsors and partners

Title Sponsor

Exclusive Sponsor

Diamond Sponsor

Communication Partner

Official Sponsor

Platinum Sponsors

Premium Sponsor

Gold Sponsors

Silver Sponsors

Bronze Sponsors

Registration Sponsor

Partners

Associated Partners

Mediapartners

Registration

FREE OFFLINE participation for employees of banks, MDOs, pawnshops, retail, executive authorities of the Central Asian republics

Free

Make appointments and contacts!

There is a QR-code with contact information on the badge of every participant:

- The company

- Department

- Position

- Contact phone number

You can scan the QR-code with your smartphone and save the business card in contacts.

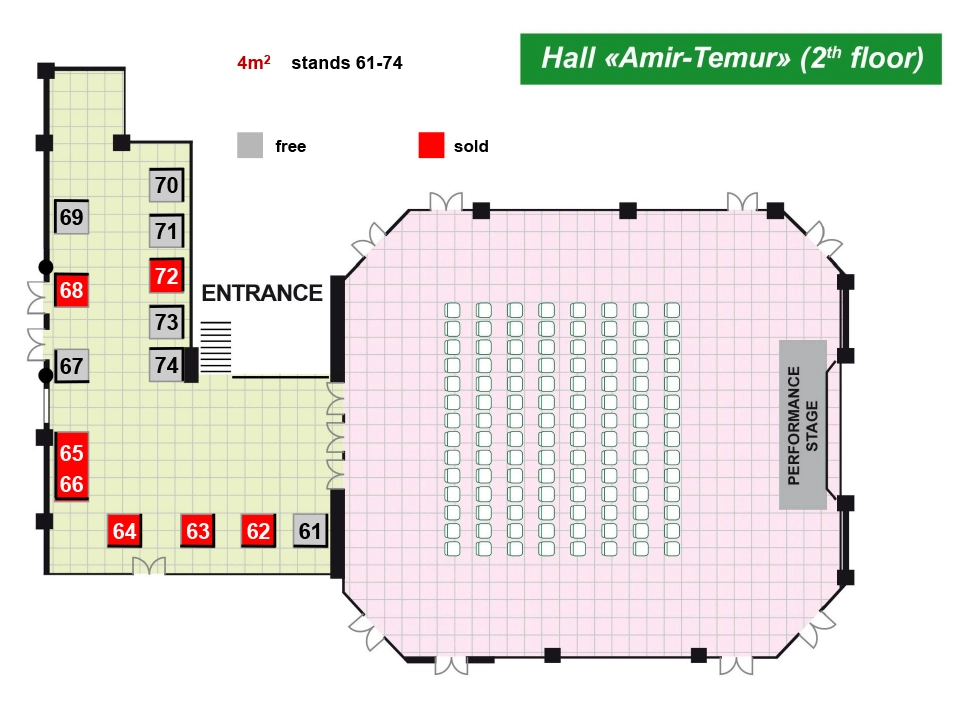

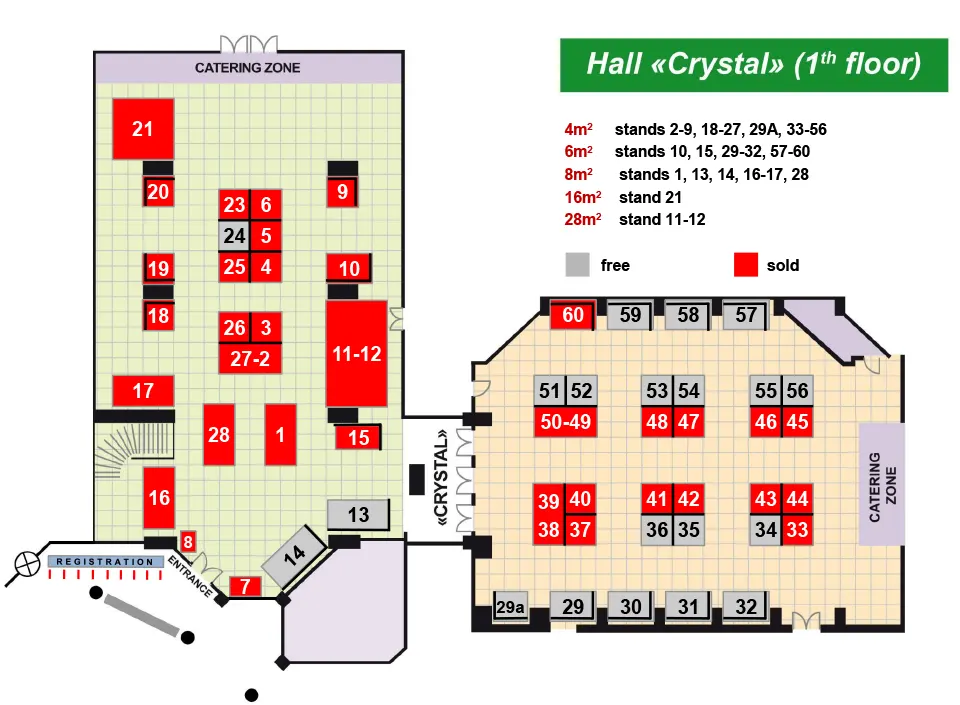

Hall plans

1st Floor

2nd Floor